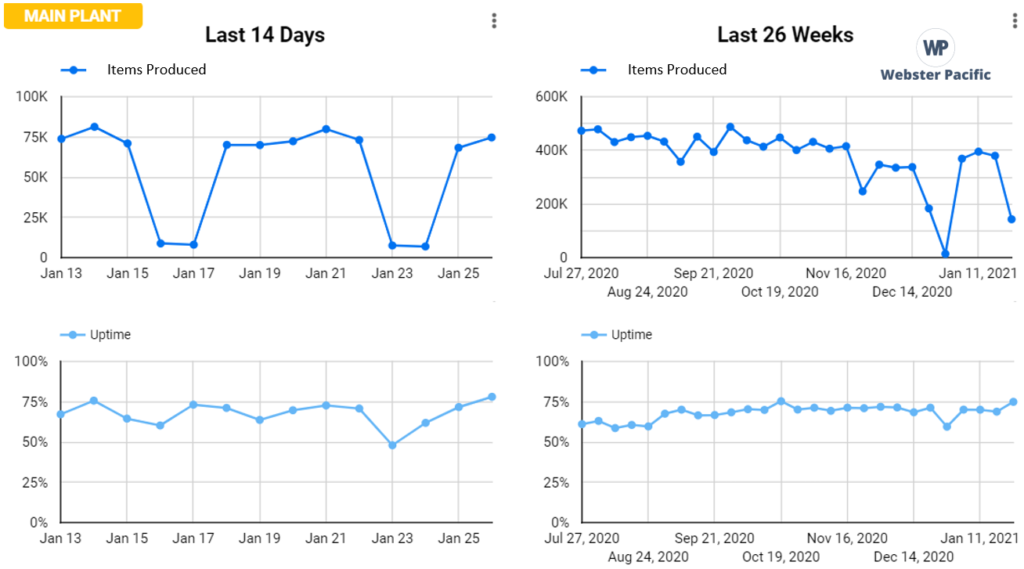

Alex Crane, a WP client since 2019, is a “breezy” linen clothing brand based in Brooklyn. The founder, Alex, and his COO Aaron have grown the Alex Crane brand over 300% YOY for the past 3 years straight. They’ve been able to maintain this impressive growth and stay profitable by staying lean in terms of employee count. As with any small and rapidly growing company, there are plenty of analytical questions to answer, but the size of their business does not warrant a full-time hire to address those questions just yet. That’s where Webster Pacific comes in.

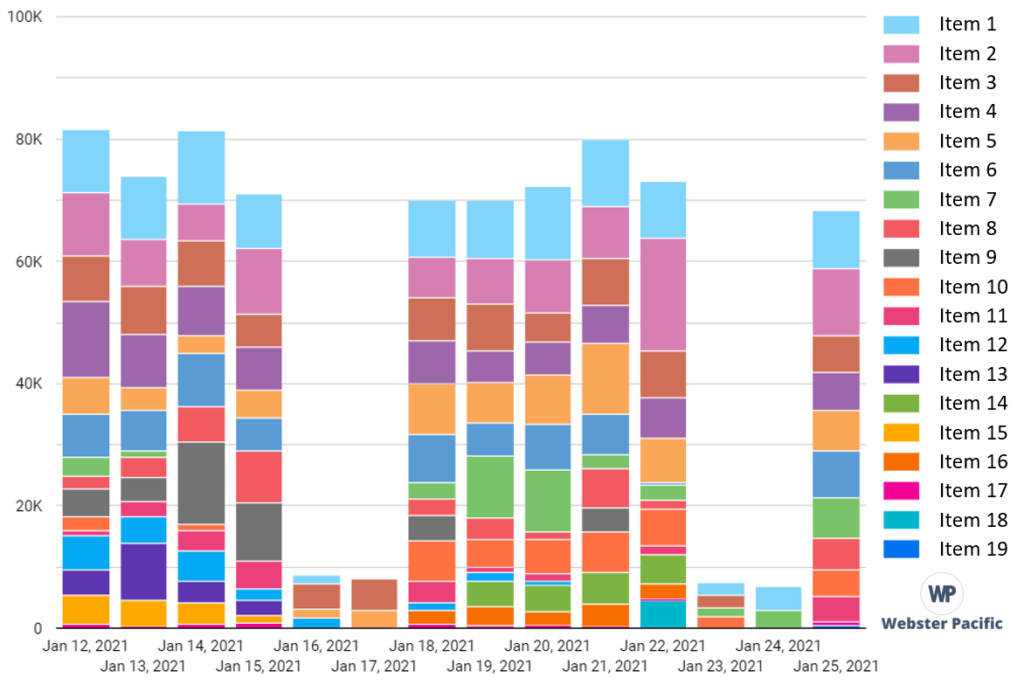

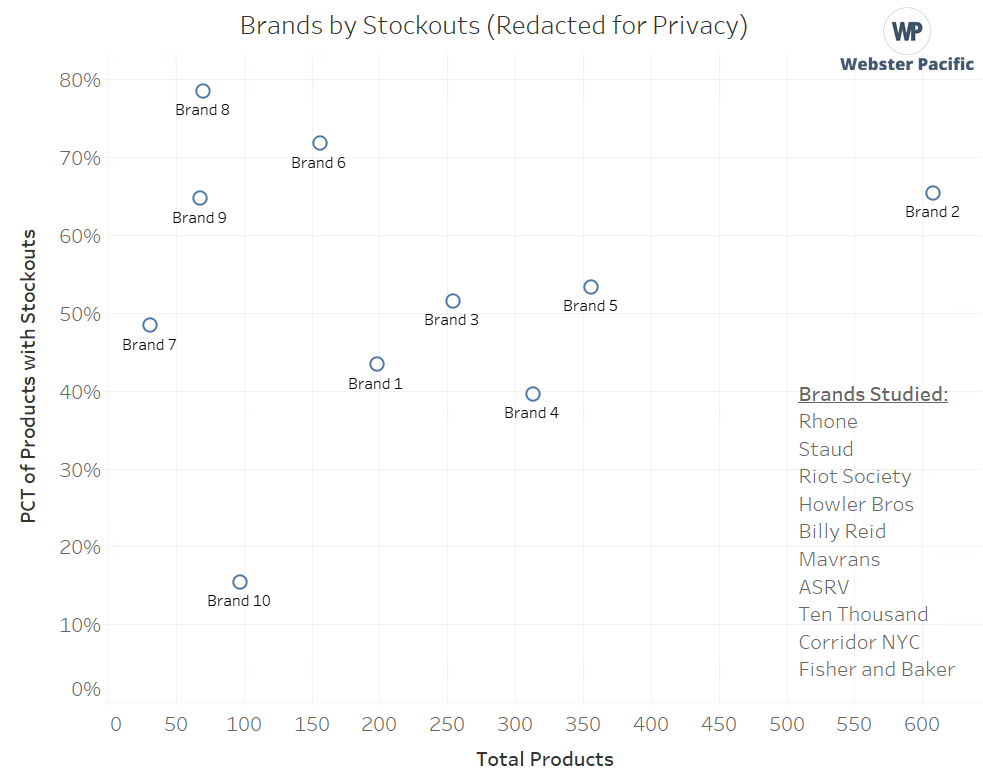

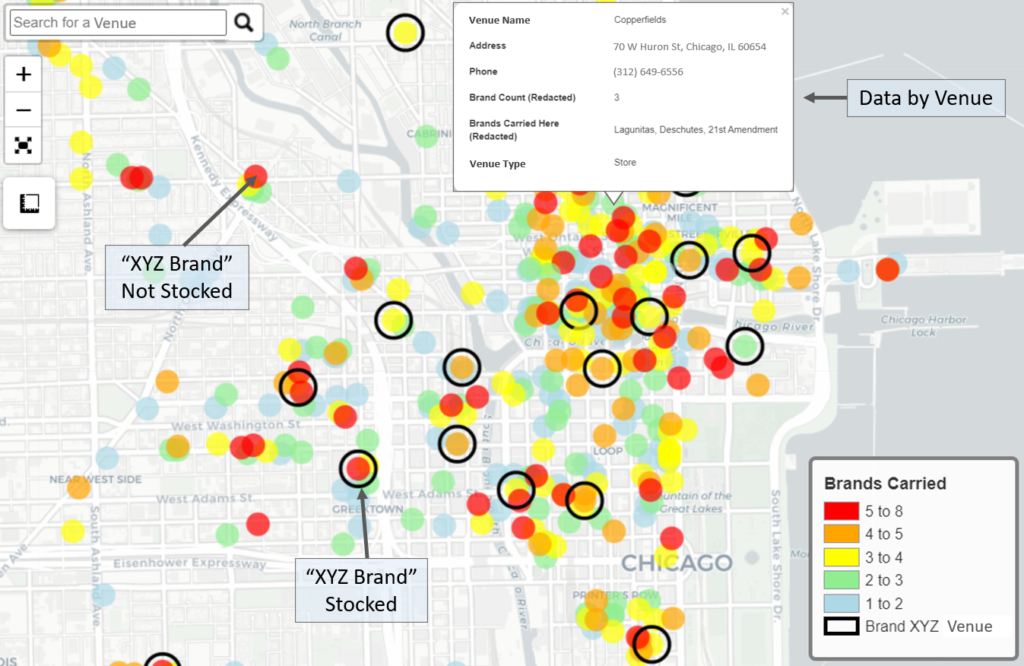

Over the past two years, WP has helped Alex and Aaron answer a variety of questions across marketing, operations, and finance. A few noteworthy projects include: 1) predicting inventory to avoid stockouts, 2) implementing attribution models to optimize marketing spend, 3) finding new wholesale accounts to grow their revenue, and 4) planning their cash flow to maintain the financial health of the brand.

Read More