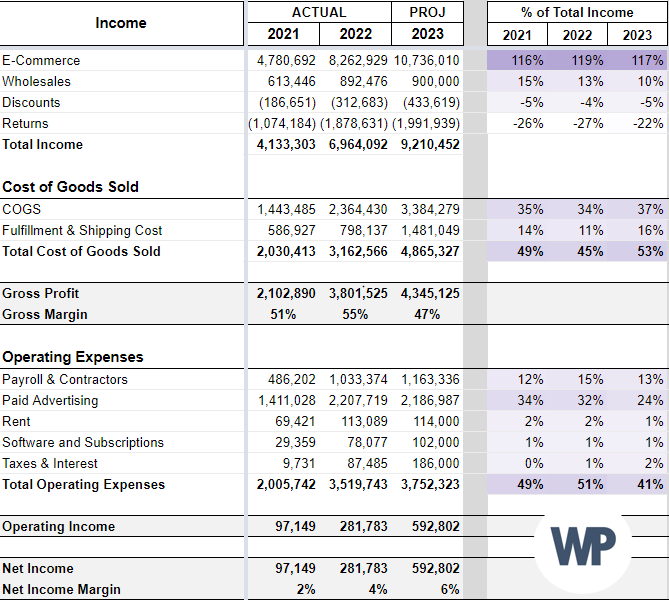

Client Question: How can we reach goals of increased profitability or growth? I want to give my employees raises, decrease my return rates, renegotiate my supplier contract, and get a bigger office – how will that impact my bottom line?

Budgets and Forecasting

How can we reach goals of increased profitability or growth? I want to give my employees raises, decrease my return rates, renegotiate my supplier contract, and get a bigger office – how will that impact my bottom line?

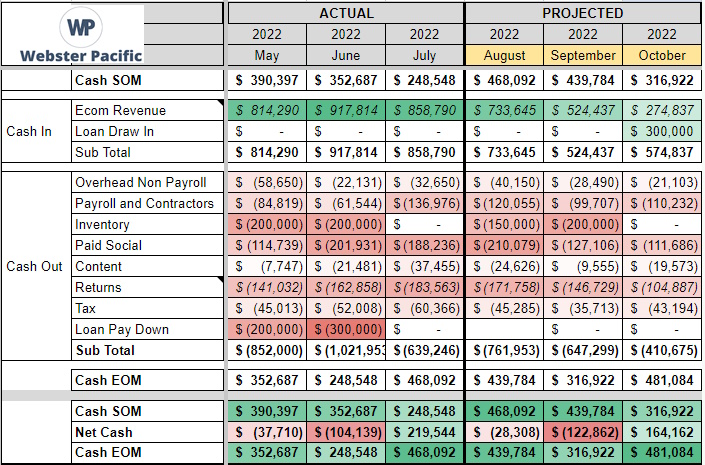

Cash Flow Projections

What do I need to do so I don’t run out of money? How big of an inventory order can I place? How much debt can I afford? How much money can I draw out of the business?

Managing Accountants

How do I understand the information my accountant is trying to tell me? How do I feel confident they are making the right decisions to keep my books clean and minimize my tax liability?

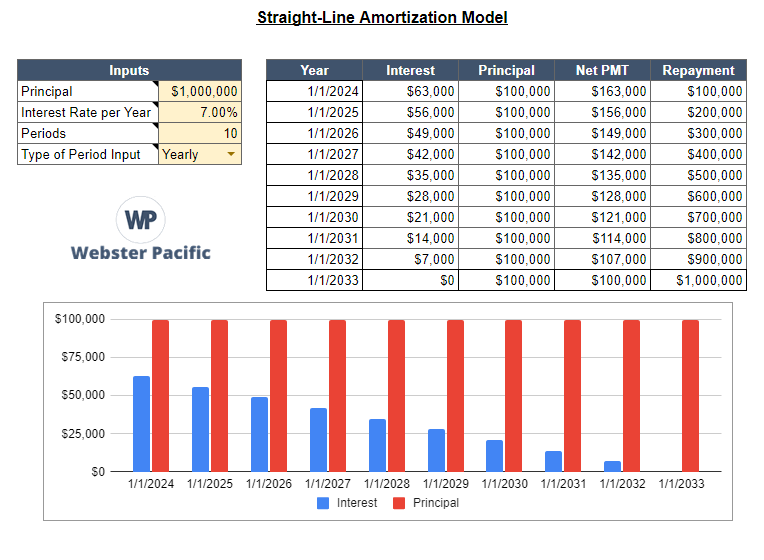

Debt Structuring

How can we compare different debt options in the marketplace and their impact on our balance sheet, cash flow, and income statement over time? What risks, covenants, liens, or other debt information should I be aware of?

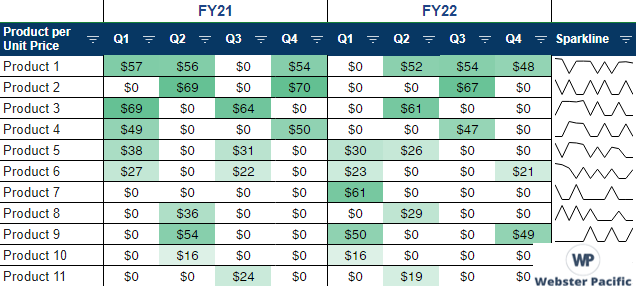

Inventory Valuation and COGs Cleanup

Tracking my inventory prices and cost of goods sold is a nightmare. How do I clean that up and establish straightforward systems of tracking these prices on an ongoing basis so I have clean books and the ability to track my costs over time?

Budgets and Forecasting

Approach: WP starts with each client’s historical financial reports and simplifies the morass of financial data into straightforward categories. Then, that data is studied, along with client input on future plans, to project business growth and profits into the future. The goal is to bring the client along in this journey so they can understand their financial past and future, giving them the confidence to make tough business decisions.

Cash Flow Projections

Client Question: What do I need to do so I don’t run out of money? How big of an inventory order can I place? How much debt can I afford? How much money can I draw out of the business?

Approach: WP starts with categorizing the client’s historical bank transactions to better understand how cash has flowed through the business in the past. We then build a model that projects where and when money will come in and out of the business. This model has the ability to pivot to changes the client wants to test, such as placing a bigger inventory order, paying themselves a higher salary, or starting a new consignment wholesale account.

Managing Accountants

Client Question: How do I understand the information my accountant is trying to tell me? How do I feel confident they are making the right decisions to keep my books clean and minimize my tax liability?

Approach: WP often serves as an intermediary between accountants and leadership to help clean up books, value inventory, perform monthly closing tasks, and translate complex financial information into actionable insights. WP can also help weigh in on complicated decisions whether to loan money to the business or inject it as equity, the impacts of opening new locations on sales tax, and an easy way to implement a FIFO inventory valuation without an ERP system.

Debt Structuring

Client Question: How can we compare different debt options in the marketplace and their impact on our balance sheet, cash flow, and income statement over time? What risks, covenants, liens, or other debt information should I be aware of?

Approach: WP starts by understanding the clients’ goals and whether they could use short-term, seasonal, or long-term capital. We then help them go to the marketplace to find financing options and then evaluate the loan terms and interest costs so the client can make an educated decision.

Inventory Valuation and COGs Cleanup

Client Question: Tracking my inventory prices and cost of goods sold is a nightmare. How do I clean that up and establish straightforward systems of tracking these prices on an ongoing basis so I have clean books and the ability to track my costs over time?

Approach: WP has cleaned up inventory price data for fashion, fabric, ceramic, manufacturing, agriculture, and just about any business you can think of. WP has the experience and tools to get this data in line in a fraction of the time it would take to do it internally with a manual process. WP meets with each client to understand their data – past, present, and future – to clean it and craft new systems to easily track the information going forward.