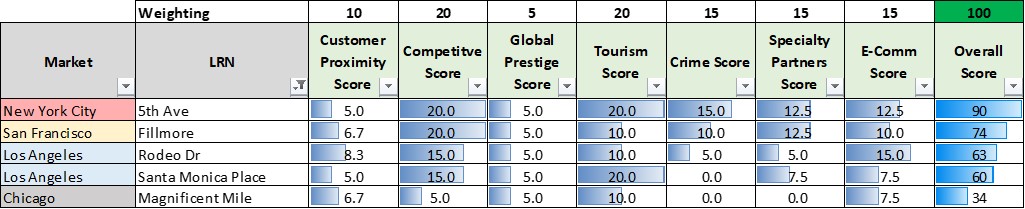

Question: Which cities should we expand to next? How many locations can each market support? How far have we penetrated each market in terms of sales?

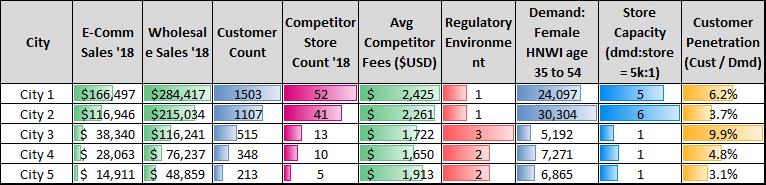

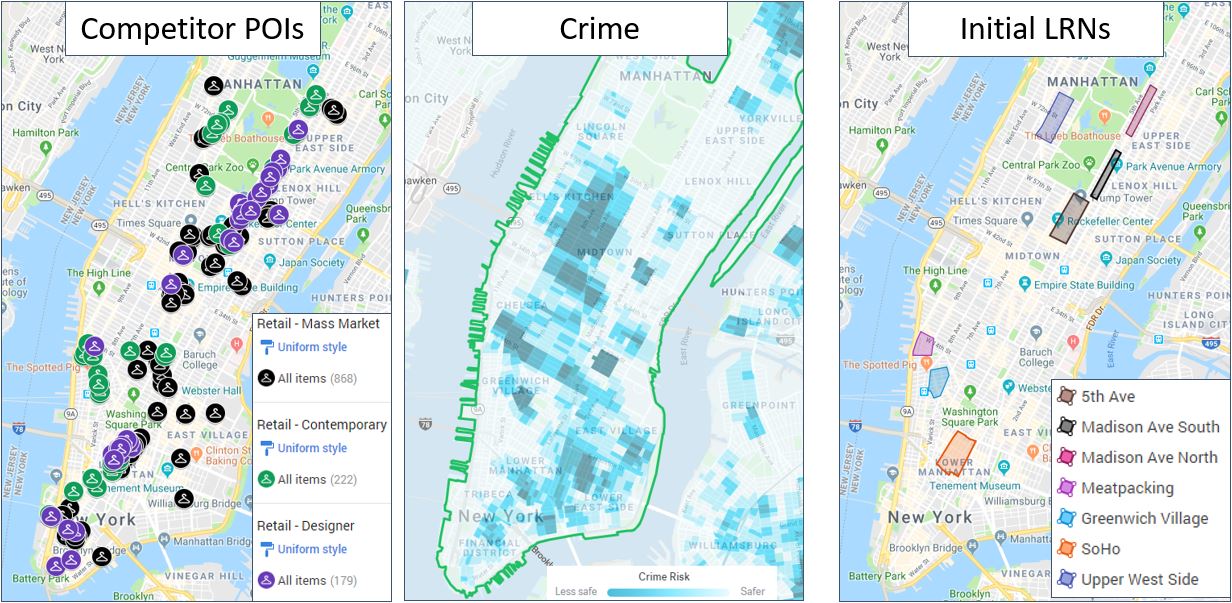

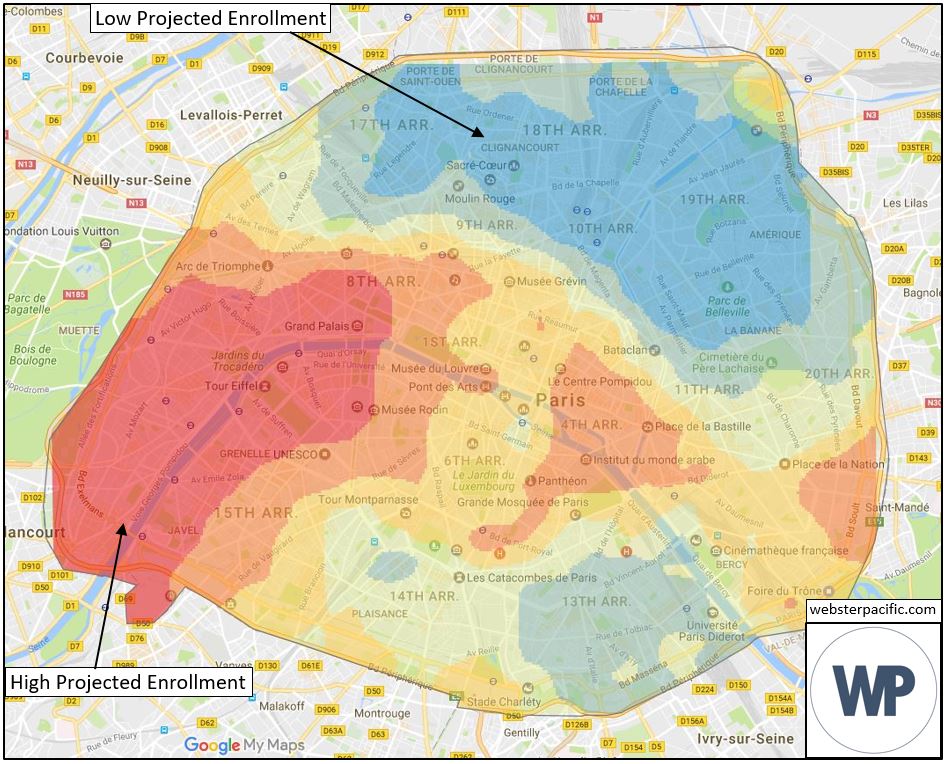

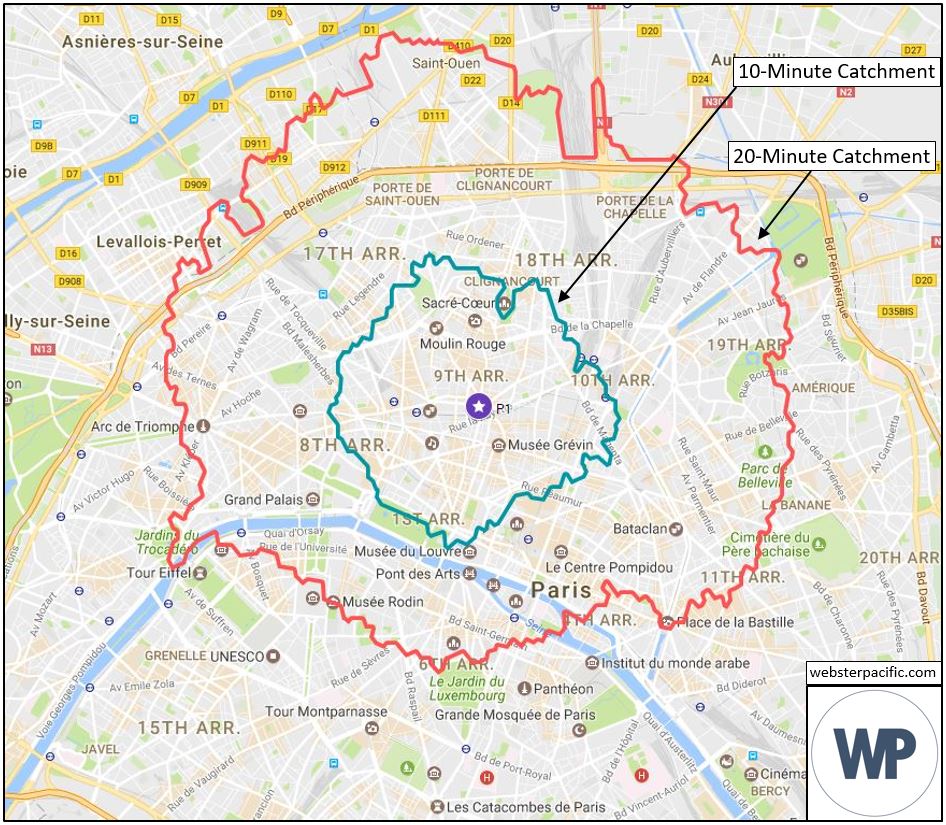

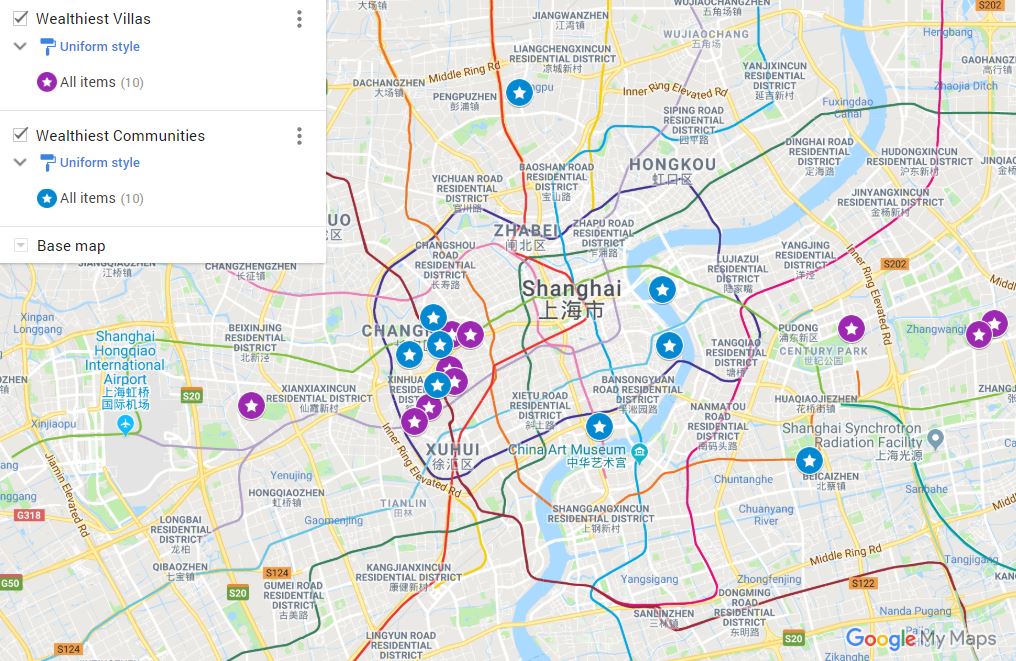

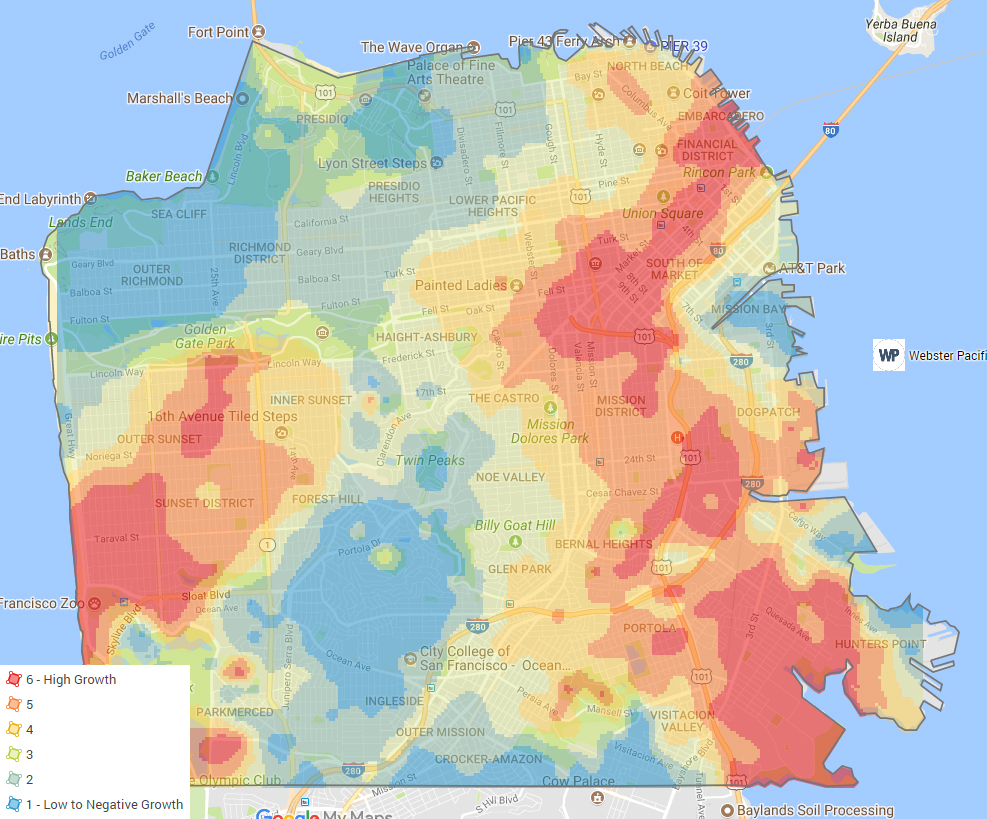

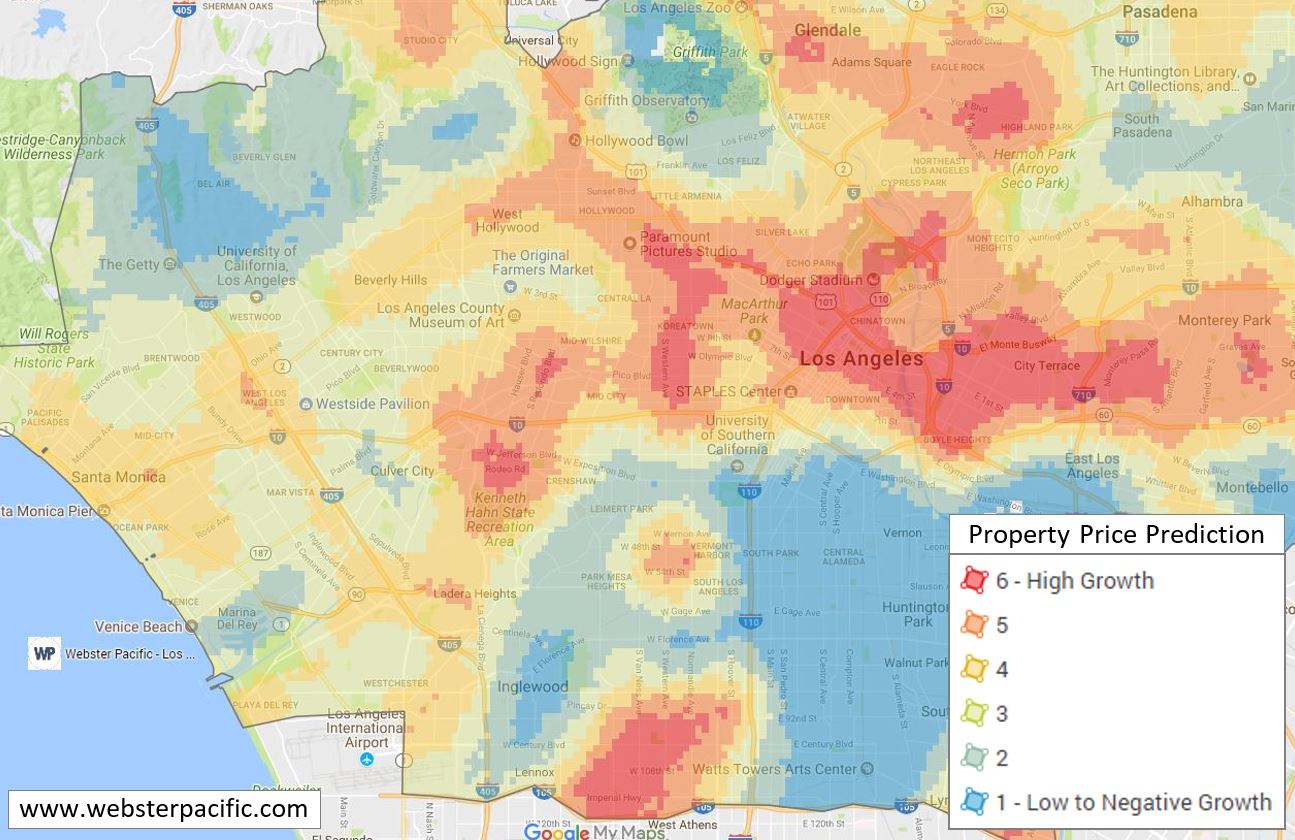

Approach: We collected a variety of metrics on major metropolitan area in the world (redacted example at right). We then worked iteratively with our client to identify the metrics of highest importance, which included: e-comm and wholesale sales, number of target customers “demand” from an income and demographics perspective, complexity of the regulatory environment, and presence of competitors.

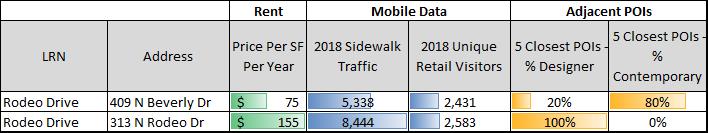

Result: We identified markets that had a significant number of target customers (aka demand), which we then compared to the number of existing customers from an e-commerce and wholesale perspective. We then converted these estimates using a customer per store ratio to identify the number of locations that each market could support.