Written by Webster Pacific Managing Partner Tom Paper. Published on Medium on March 19th, 2018.

Getting US data is easy. Getting international data is hard. For many reasons, US data about demographics and wealth is easy to find, even on a micro-geographic basis, but in virtually every other country in the world, finding data about demographics and wealth is very hard.

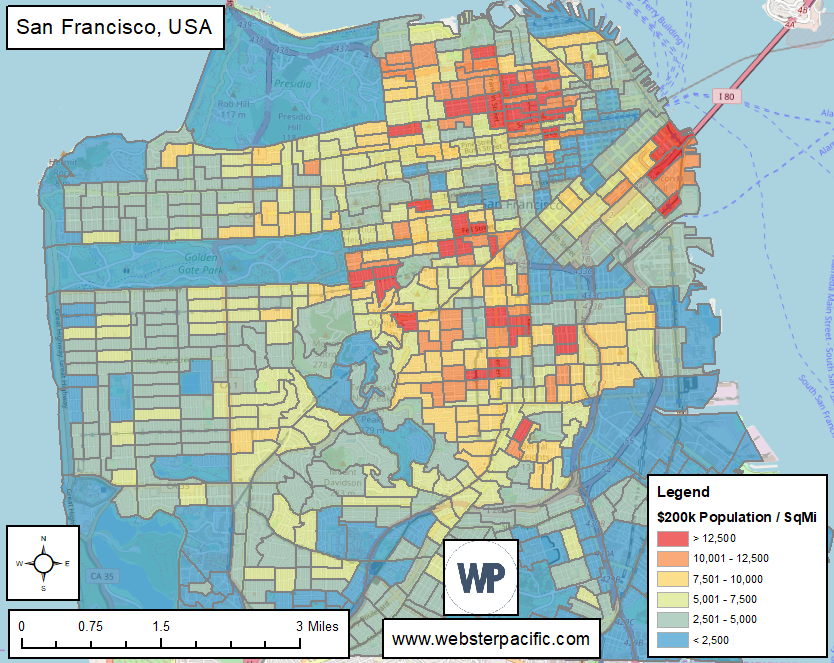

Our firm has been engaged for the past four years in helping clients understand where wealth is located in both US and international markets. In the US, we are fortunate to have the Census Department[1], which offers extensive demographic data about things like the number of people of various age groups and varying levels of household income. This data is available on a micro-geographic basis, which technically is called a “block group”[2]. These small geographies are roughly one-half square miles and contain about 1,500 people. The entire United States is covered in about 210,000 block groups. The Census also provides block group data about the number of households of various income categories, with $200,000 and over as the highest category. If you want to find out about higher income categories, you need to go to Claritas, formerly a part of Nielsen Corporation, where you can buy data about households with incomes of $500,000 and over.

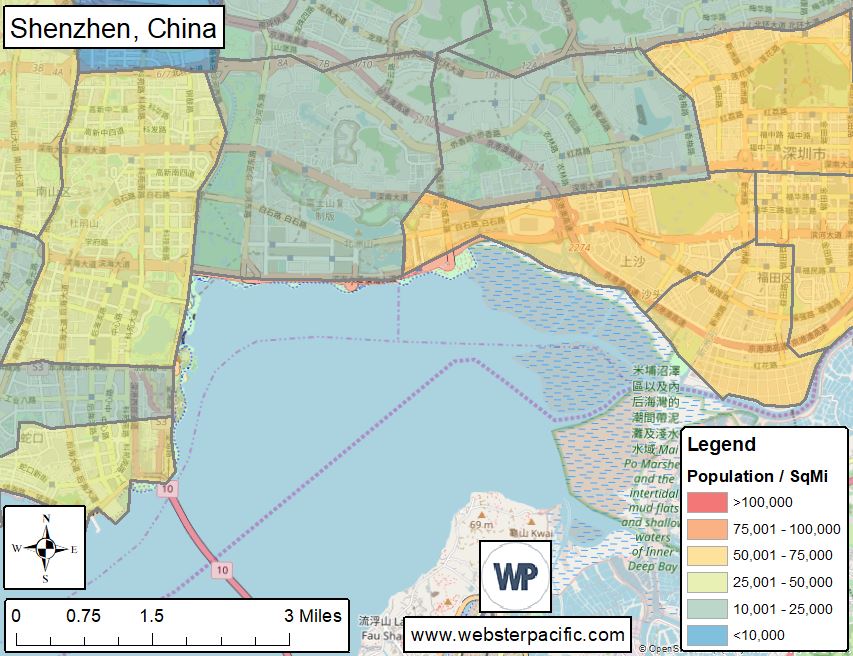

In markets outside the US, getting demographic and wealth data is a whole new ballgame: wealth data is virtually non-existent. Demographic information totally depends on the country. For example, in the UK, demographic information is available on a very micro-geographic basis, but in China, demographic information only comes in very large geographies, roughly 5 square miles per subdistrict, which is 10 times larger than the geographies available in the US.

We put together a couple maps to describe these differences between the data available in the US and other countries. The two maps below have exactly the same scale. In San Francisco, the geographies are much smaller, and the data shown is about wealth. In Shenzhen, China, all that is available is population and only in much larger geographies.

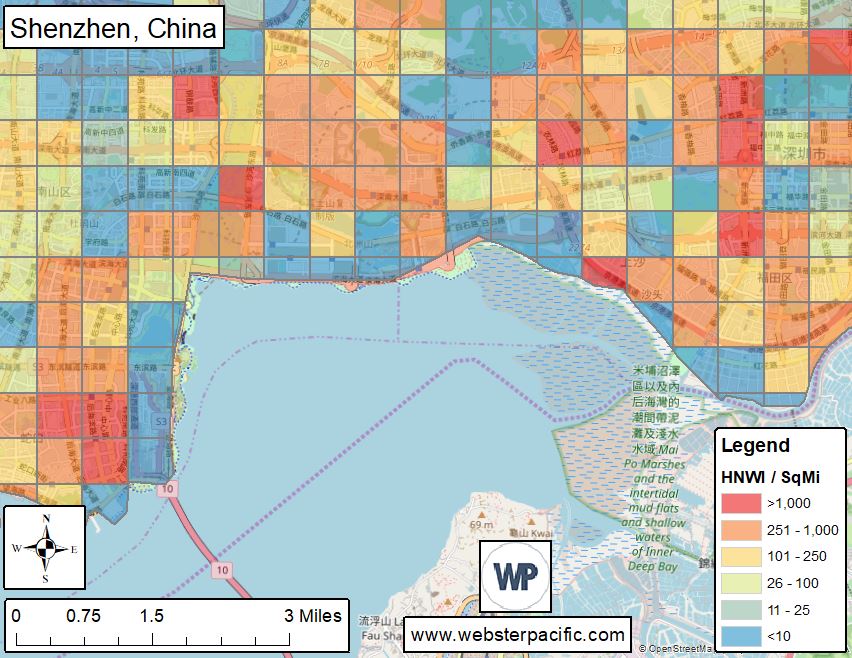

So, what do you do to get wealth data in a place like Shenzhen? The good news is that we are living in the “big data” revolution. Firms like ours and a few others are engaged in mining and developing data to address the need to make data-driven decisions in international markets. Webster Pacific has been able to develop detailed estimates of wealth on a very granular basis in over thirty international markets. We’ve done this by collecting data from various sources, performing calculations on that data and then rigorously organizing and presenting that data in a manner that is both easy to understand and actionable. Ok, but this isn’t alchemy, right? What data specifically are we collecting to generate micro-geographic estimates of wealth? Here’s a short list:

- We get whatever demographic data we can get by whatever geographies are available in each country.

- We collect road density information, nighttime satellite imagery, building sizes and various other data.

- We collect real estate data, to better understand real estate prices on a micro-geographic basis.

- We marry the three above types of information together using high-powered computing and algorithms. Most of our number crunching activities are so voluminous they must run overnight.

The bottom line is that while international data is hard to get, it’s not impossible. The map below shows our estimate of wealth, High Net Worth Individuals (HNWI), in Shenzhen, China.

International wealth data isn’t perfect, but then again, no data is perfect. The key is to know your assumptions, be flawless in your calculations and understand the level at which your data provides insights.

-Footnotes-

[1] https://www.rollcall.com/news/policy/2020-census-congress-funding — there has been some question about what will happen to funding of the 2020 census.

[1] https://en.wikipedia.org/wiki/Census_block_group — Block Groups typically have a population of 600 to 3,000 people. See also http://proximityone.com/blockgroups.htm