Written by Webster Pacific Consultant Steve Bazant. Published by Propmodo on October 23rd, 2017.

Recently, I was sitting down with a contact who works at a premier commercial real estate (CRE) investment company with a nation-wide portfolio. We were discussing his national portfolio and the types of markets in which the company usually invests. At one point during our conversation, he said something that struck me: “Our current strategy is to only invest in sunbelt markets.” His reasoning here was that these markets are “up and coming”. I knew that this contact had huge success in the world of CRE, but I found myself thinking, what does “up and coming” even mean? How do you prove that? How could a national investment strategy be the southern half of the entire country?

After stewing on the conversation for a couple of weeks, I solidified a couple of questions I wanted to answer: How should CRE investors choose markets to invest in and what data should they consider to drive that decision? I had a feeling that a strategy as broad as any state south of the 36th parallel wasn’t a data-driven strategy, so I set out on a journey to explore other courses of action.

After wading through oceans of data, I found that a market selection strategy can and should be driven by structured, objective data rather than unstructured data or anecdotal information. A combination of census and housing sale price data is a cornerstone of a cross-market investment strategy. Furthermore, to capitalize on market growth, the rates of change of these metrics should be carefully considered.

Now, as you may expect, I have concluded that there is not a single metric or even combination of metrics that addresses the market selection strategy of every investor. The reason being that every industry and every investor is different, and, therefore, every strategy should be supported by the appropriate data! In other words, the metrics you choose to form your market selection strategy should match the type of commercial property you are investing in. To show this, I’ve organized three different CRE investment use cases along with scatter plots of data that I think are relevant, gathered from the American Community Survey and Zillow.

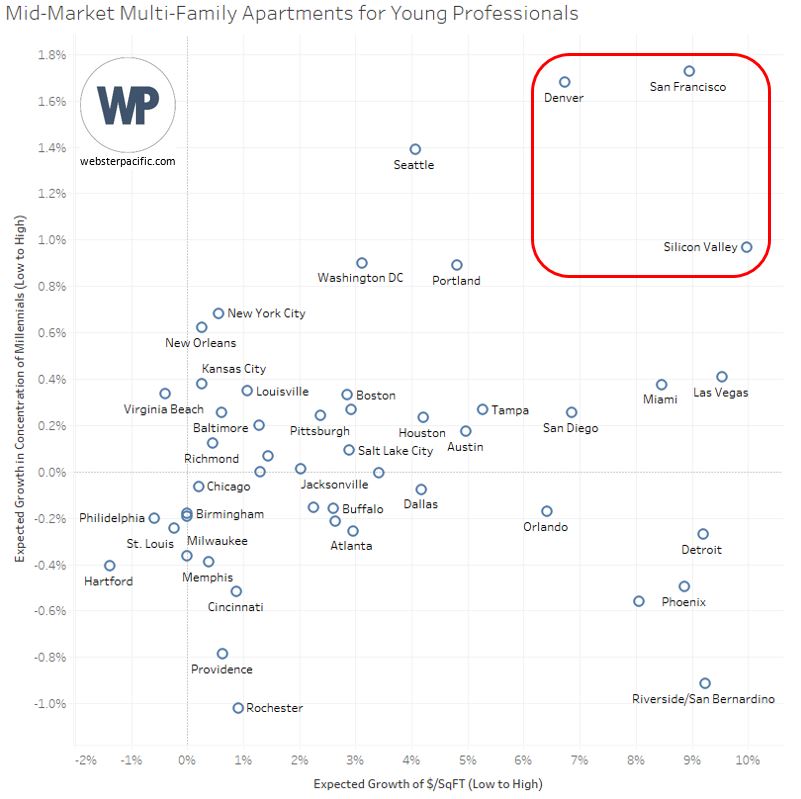

For the first example, let’s consider an investor who wants to expand her national portfolio of mid-market, multi-family buildings targeting young professionals. For her investment strategy, it would be prudent to look at which cities have the highest expected growth of real estate price per square foot and the highest expected growth in concentration of millennials. The scatter plot below suggests targeting San Francisco, Denver, and Silicon Valley.

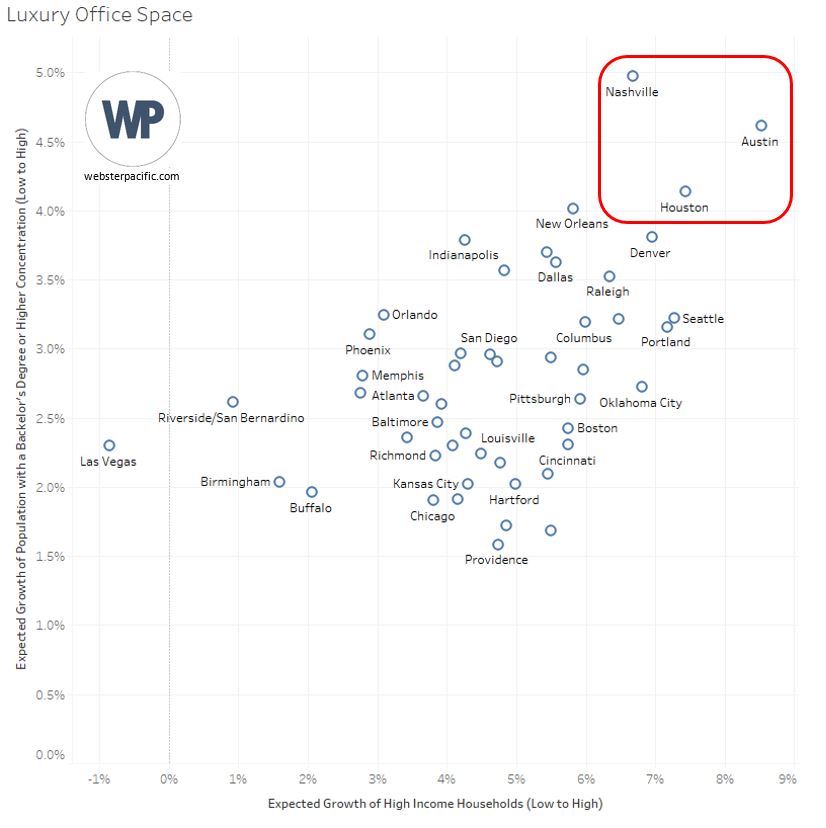

For the next example, let’s consider an investor who wants to expand his national portfolio of luxury office buildings. The demand for this type of commercial real estate may be driven by wealth and educational achievement. To find which markets are getting wealthy the fastest, he may want to look at the expected growth of high household income concentration. To find which markets are likely to need more office space in general, he may want to look at the expected increase in the percent of the population with some level of higher education. The scatter plot below points out that Nashville, Austin, and Houston may be the best markets in which to invest.

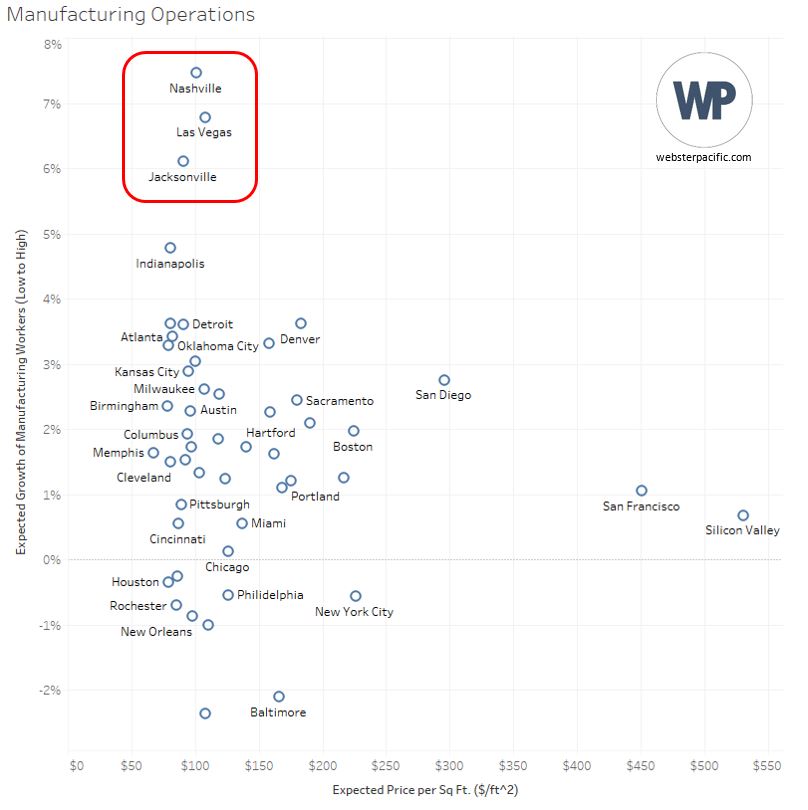

For the last example, let’s say that you are Amazon and you want to move one of your factories that assembles basic household items from Asia to the US to cut down on shipping costs. The best place to open a factory may very well be where there is high expected growth in manufacturing workers and low expected real estate costs. The scatter plot below finds that Nashville, Las Vegas, and Jacksonville may be the most promising markets.

Even though these examples have just a few of the building blocks needed to construct a robust market selection strategy, it gives you a taste of what a data-driven approach can look like. So, if you’re a REIT or a specialty housing developer, you can see that a national strategy can be more informed and better focused than anecdotal information.

Propmodo is an online news source that focuses exclusively on commercial real estate technology. This article was originally published on October 23rd, 2017 on Propmodo.