Webster Pacific continues to expand analytical capabilities for real estate investors of all asset classes. We gather data for our clients on demographics, income, competitive supply and alternative data like proximity to quality restaurants and transit. See below example of demographic data that a multi-family (apartments) investor may want to consider when investing in Philadelphia. You can also watch a video of Steve presenting the data here.

Read MoreArticles & Events

Download the full report via this link.

Executive Summary:

Webster Pacific and United Van Lines collaborated to better understand the impacts of Covid-19 on USA moving trends. Using United Van Lines data, Webster Pacific studied moves by zip code and metro area over a two-year period across the contiguous United States. This report finds that Covid-19 has caused people to move out of the largest metro areas, favoring smaller metro areas. Additionally, people are moving out of New York/New Jersey and California at higher rates due to Covid-19 and moving into the South and the Midwest Plains.

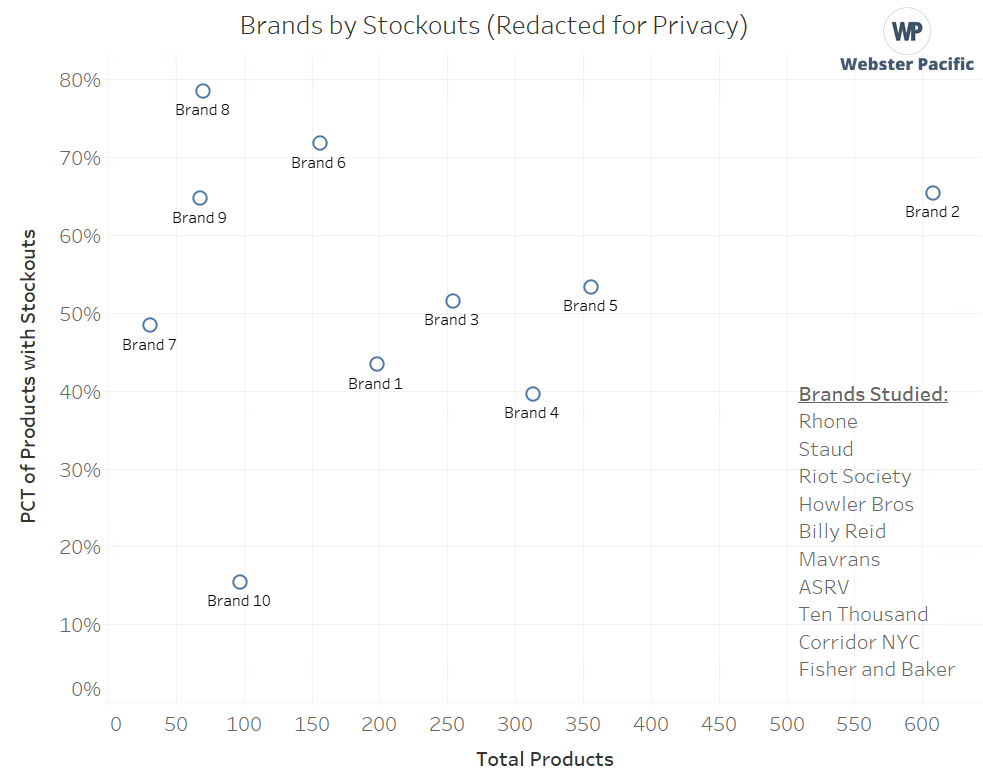

Read MoreBecause many of our clients are e-commerce companies, we were curious to know what level of stockouts are experienced by other e-commerce companies. We were quite surprised to find that 9 out of 10 companies we studied had 40% or more of their products stocked out. This would be like a grocery store having 4 out of 10 shelf spaces empty. We think this situation represents a significant revenue opportunity for e-commerce companies, and we have developed and implemented a solution.

Download the full report via this link

Introduction

This report is compiled by location analytics specialists Webster Pacific (www.websterpacific.com) and wealth intelligence firm New World Wealth (www.newworldwealth.com). The wealth and HNWI figures in the report are for June 2020 and they therefore take into account the impact of the recent coronavirus outbreak.

Contents

- Introduction

- Benchmarking US wealth in context

- The wealthiest cities in the US

- USA luxury vacation index

- Spotlight on luxury residential estates

- The Coronavirus impact 1H 2020

- Wealth vs GDP

- Research and methodology

2020

JUNE 24, 2020: LUXURY RETAIL MARKETS PREDICTED TO BE MOST NEGATIVELY IMPACTED BY COVID-19

PressLeave a commentDownload the full report via this link.

Executive Summary

Covid-19 has dramatically impacted tourism and, in particular, international tourism. Certain luxury retail markets are more dependent upon tourism than others. Our analysis predicts that the luxury retail markets most negatively impacted by Covid-19 will be those markets with the greatest presence of luxury retail AND the greatest international tourism per capita. We predict that the luxury retail markets of Miami, Honolulu, and Las Vegas will be the most negatively impacted.

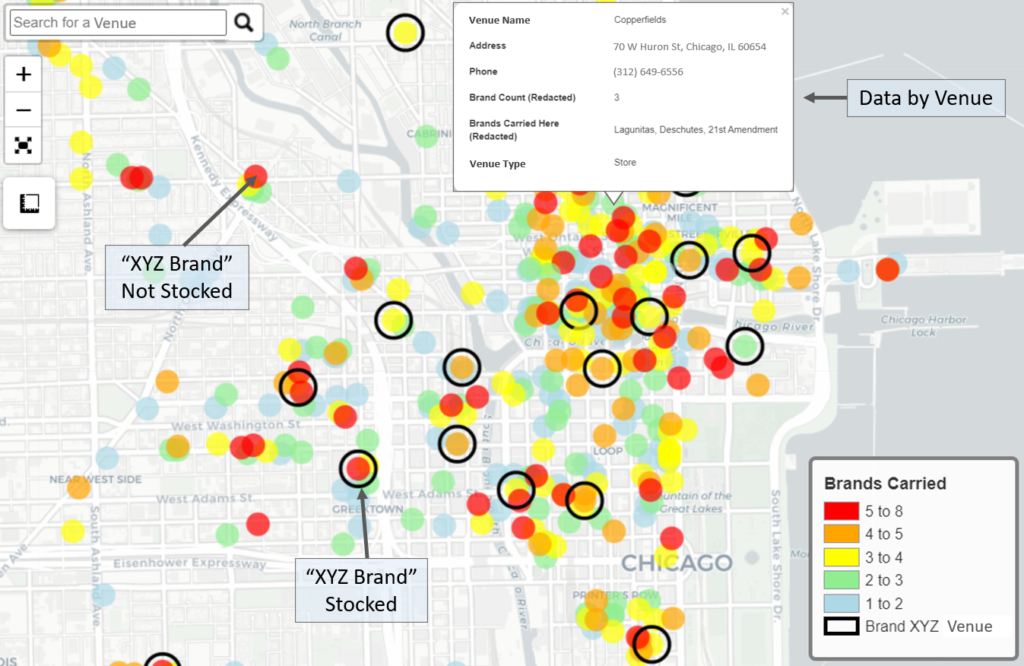

Read MoreSpecialty food and beverage companies (e.g. craft beer) have lost substantial revenue from COVID-related closings of restaurants. Fortunately, most stores are still open. To help find revenue opportunities, Webster Pacific built a tool to find stores (and other venues) where your competitors are carried and you aren’t. The redacted example below shows venues in Chicago where “XYZ Brand” of beer is stocked and other venues where competitors are stocked. This tool can be used as a hunting list for salespeople and a market strategy tool for leadership. You can interact with the map here.

In the current environment, retail store sales are basically nonexistent, which means that brands are being forced to rely on Ecomm. To that end, we have been helping our clients use geospatial data to find MSAs and Zip Codes where their Ecomm is weaker than it should be. We do this by comparing our client’s Ecomm sales (where they are successful) to the presence of their competitor’s physical locations (where they should be successful). The scatter below shows a client under-performing in Midwestern markets.

Read More2020

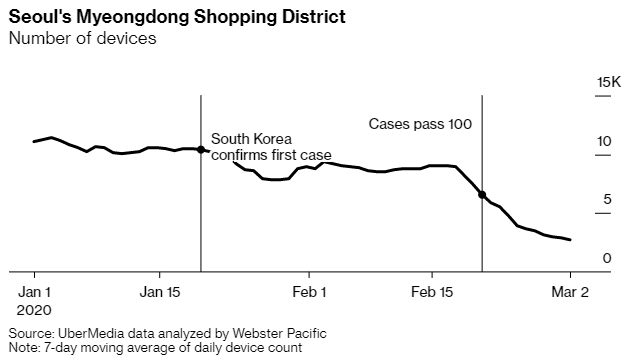

MARCH 5 2020: MOBILE-PHONE DATA SHOWS VIRUS CRUSHING SOME RETAIL HOT SPOTS

ArticleLeave a commentWritten by Bloomber’s Jonathan Levin. Published on Bloomberg on March 5, 2020

Mobile-phone data — a proxy measure for crowds — is showing just how dramatically some of the world’s retail hot spots have cleared out as coronavirus spreads.

***You can read the rest of the article on Bloomberg via this link

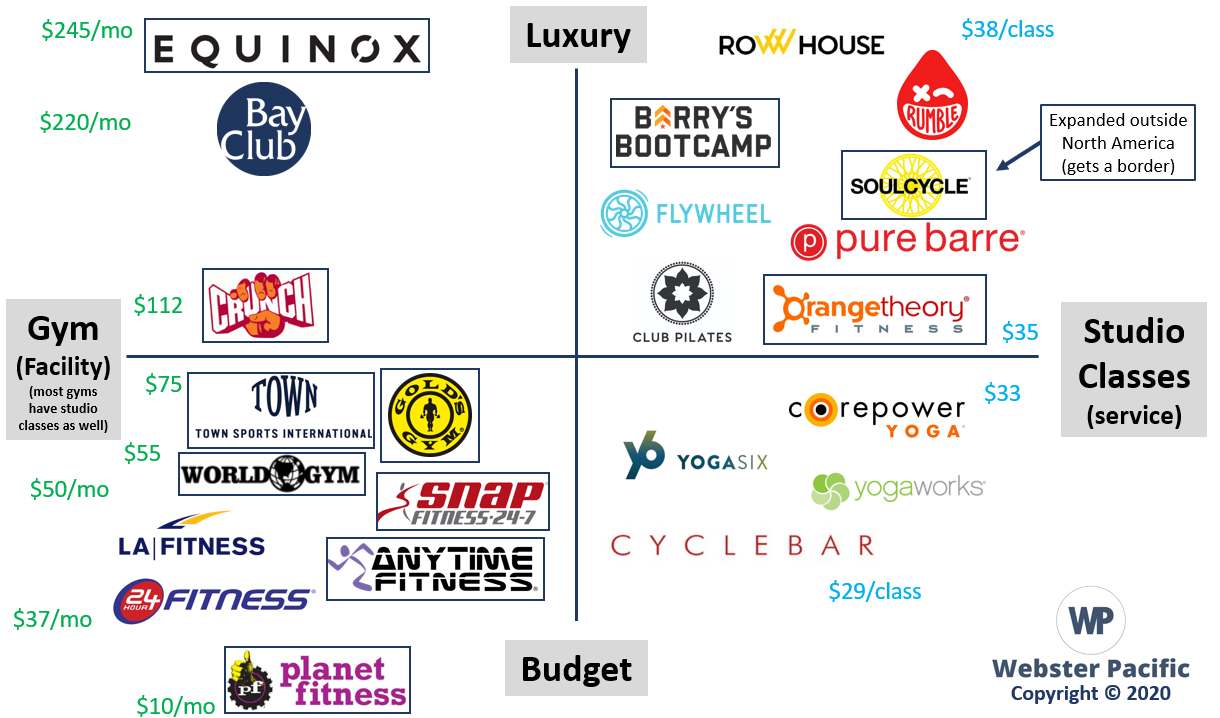

Webster Pacific believes that the foundation of any analysis is strategy. In our location analytics work, we go beyond what software tools and real estate brokers provide, by thinking deeply about our clients’ business and how they are strategically positioned. This means understanding the competitive landscape. We created the below 2×2 matrix to better understand the fitness landscape.

- Gyms have expanded outside of the US more than studio classes. This is a function of 1) gyms are easier to franchise and 2) the concept of studio fitness is newer than gyms.

- Equinox is not being challenged in the luxury gym space. Most competitors are in-market high-end clubs (like Bay Club, which is only on the west coast).

- There is a much smaller price-spread for studio classes than for gyms.

Wealth intelligence firm New World Wealth and location analytics specialists Webster Pacific recently reviewed the top cities worldwide by total wealth held. See top 20 below. As part of this study, Webster Pacific created heat maps for certain major cities to give a better indication of which neighborhoods are the wealthiest in each city.

Download Press Release: World cities 2019

Wealth Maps: London, Dubai, Mumbai

Coverage: Quartz, Khaleej Times 1, Khaleej Times 2

![]()